Multifamily Loans (2–4 Units)

Own More. Earn More. Live Free.

Most people grind for 40 years and retire broke.

Or…

You can start collecting rent while they’re still punching time cards.

Why 2–4 Unit Properties Are the Smartest Way to Start

Forget flipping. Skip single family.

Here’s why 2–4 unit multifamily buildings are the cheat code for wealth:

Triple Play Wealth Formula:

Appreciation – The property grows in value

Debt Paydown – Tenants pay your mortgage

Cash Flow – Monthly profit while you sleep

You’re in Control:

Raise rents = Raise value

One roof, multiple incomes

Better tax benefits than single family homes

Not Sure Where to Begin?

Start with your “Buy Box.”

📍 Location: Where do you want to invest? What tenants are you targeting?

🏢 Property Type: Ready-to-go or fixer-upper?

🔧 Value-Add Potential: Can you add a bedroom, improve layout, or raise rent?

💰 Cash Flow Goals: Most aim for 7%+ cash-on-cash returns

Financing Options

Choose what fits your life (we help you with this).

-

🔹 5–25% Down

🔹 640+ credit (700 = better rates)

🔹 Must have 6 months reserves

🔹 PMI if <20% down

🔹 Fannie (5% down w/experience), Freddie (15–20%, no experience needed)

Best for: Strong credit buyers ready to scale fast.

-

🔹 Only 3.5% down

🔹 580–640 credit minimum

🔹 Up to 55% DTI

🔹 Self-sufficiency test for 3–4 units

🔹 Allows rehab with 203k loan

Best for: First-time house hackers or buyers with low savings.

-

🔹 0% Down

🔹 No PMI

🔹 Lower interest rates

🔹 Can include rehab costs

Best for: Eligible veterans—hands down the #1 option.

Want to Buy & Renovate? Use These Loans

Perfect for:

Buying distressed properties and increasing value from Day 1.

FHA 203(k)

3.5% down

Limited (up to $75k) or Standard (no cap)

Must meet FHA self-sufficiency test

Fannie Mae Homestyle

5% down

Covers creative and large projects

More flexible than FHA

How the Loan

Process Works

Simple. Efficient. Designed for busy professionals.

-

Stick to 2–4 units.

-

Conventional, FHA, or VA.

-

Submit documents (we guide you through it).

-

Finalize the loan, move in or rent it out.

Step-by-Step:

💡 Pro Tip: Future rental income from other units helps you qualify — even on FHA!

Crunch the Numbers Like a Pro

Want to know what you can afford?

Use our free mortgage calculator

👉 Click here!

We’ll help you factor in:

PITI (Principal, Interest, Taxes, Insurance)

Maintenance & reserves

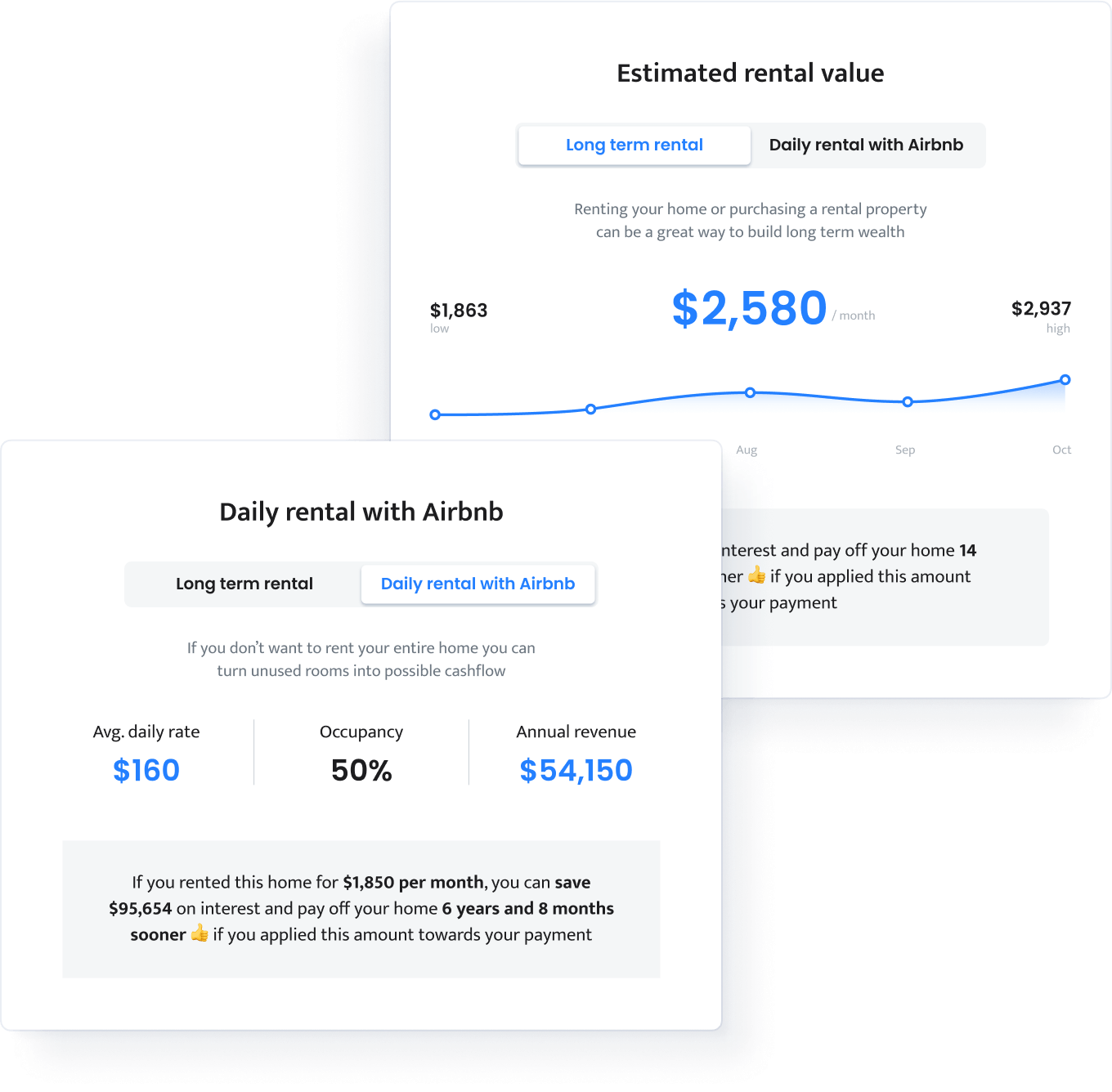

Rental income projections

(we use 75% of market rents to qualify you)